October 2024 Budget: Key EV News

On October 30, 2024, Chancellor of the Exchequer Rachel Reeves of the UK Labour government unveiled a highly anticipated budget that sent ripples across multiple sectors, especially the electric vehicle (EV) industry.

Against a backdrop of economic challenges, the government’s £40 billion budget announcement sparked interest and concern for EV owners, industry leaders, and environmental advocates.

While the budget was seen as a mixed bag, certain measures aimed to encourage the growth of the EV sector, although some pressing issues, such as cuts to public charging VAT, went unaddressed.

This article dives into the key takeaways from the budget, examining how these changes impact EV owners, businesses, and the broader green transition.

Chapters

Tax Rises

The headline of this budget was undoubtedly the significant tax rises, with over £40 billion introduced across various sectors.

EV stakeholders may view these increases as necessary measures to counter the economic strain, but for those hoping for incentives to offset rising EV ownership costs, the budget had limited news to offer.

The focus on tax raises aimed to stabilise the economy, but the direct impact on EV incentives was subtle.

Fuel Duty Freeze

Despite pre-budget discussions suggesting a possible increase, fuel duty remains frozen, continuing a policy that has resulted in over £80 billion in foregone revenue since 2011.

For EV proponents, the freeze represents a missed opportunity to deter internal combustion engine (ICE) usage and shift momentum toward electric alternatives.

The government’s decision to keep fuel duty steady may resonate with ICE vehicle owners facing financial pressures, yet it underscores the lack of additional support for those transitioning to EVs.

For EV owners, charging costs continue to vary significantly depending on access to home charging.

Charging at home remains by far the cheapest option for refuelling an EV, allowing owners to take advantage of off-peak electricity rates, saving substantially over time compared to public charging.

However, many EV owners, especially those in urban areas or without driveways, lack the option to charge at home.

For these drivers, alternative solutions like charger sharing schemes, such as Joosup available for iOS and Android, offers a practical and cost-effective way to charge.

Joosup connects EV owners with local hosts who share their private chargers, enabling convenient access to charging at more affordable rates than many public options.

These community charging platforms are increasingly valuable as they not only reduce charging costs but also expand charging availability in areas underserved by public infrastructure.

In the current economic climate, such innovative solutions provide a meaningful way to support the growing number of EV drivers without dedicated home charging facilities.

BIK Extension Until 2030

For EV owners and businesses, one positive outcome from the budget was the extension of Benefit-in-Kind (BIK) tax relief on electric vehicles until 2030.

BIK, which allows businesses to offer EVs as a tax-efficient benefit, has been extended with a gradual increase in rates up to 9% by 2030.

This measure gives clarity for businesses and individuals looking to commit to EV leasing and salary sacrifice schemes, providing long-term visibility for EV users despite the gradual rise in BIK rates.

Compared to ICE vehicle rates, EV BIK rates remain significantly lower, underscoring the government’s intent to encourage EV adoption in the corporate sector.

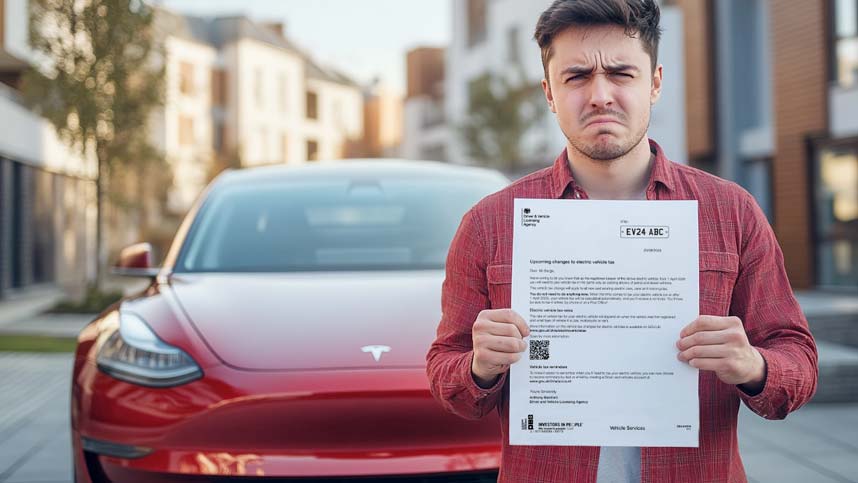

First-Year VED Rates

From 2025, EVs will no longer be exempt from Vehicle Excise Duty (VED), a decision introduced by the previous government.

Under the new structure, EVs will face first-year VED charges, though the rates remain comparatively lower than those for ICE vehicles emitting over 76g/km CO₂, which will double.

While the upcoming VED changes reflect the government’s intention to create a balanced tax approach, they add a new cost consideration for prospective EV buyers.

Notably, the government has opened a consultation regarding the controversial ‘Expensive Car Supplement’ in VED, which could potentially bring more favourable adjustments for EVs in the future.

100% First Year Allowances Extended

The budget brought a welcome extension of the 100% first-year allowances for zero-emission cars and EV charge points, now available until March 31, 2026, for Corporation Tax and April 5, 2026, for Income Tax.

These allowances allow businesses to offset their investments in zero-emission vehicles and charging infrastructure, reducing tax liabilities in the first year of purchase.

While the extension is temporary, it continues to encourage companies to make sustainable investments, especially in fleet electrification and workplace charging solutions.

Plug-in Vehicle Grants

In a boost for EV vans and accessibility, the government announced a £120 million fund for plug-in vehicle grants.

These funds are earmarked for electric van purchases and the development of wheelchair-accessible EVs, a step that recognises the growing demand for sustainable options in the commercial and accessible transport sectors.

Given the supply issues in the van market, this grant provides essential relief, ensuring businesses and individuals can transition to electric vans with some financial support.

Support for Gigafactories & EV Rollout

To strengthen the UK’s EV ecosystem, the government pledged £2 billion to support the automotive sector, with a focus on gigafactories and EV rollout.

Although details remain limited, this investment aligns with the broader modern industrial strategy, designed to enhance the nation’s capacity for battery manufacturing.

Gigafactories are critical to reducing EV production costs and securing a stable supply chain, which could help the UK meet the growing EV demand domestically and internationally.

Accelerate EV Chargepoint Rollout

One of the most promising announcements for EV owners was the allocation of over £200 million in 2025-26 to accelerate the rollout of EV charge points.

This funding aims to support local authorities in establishing on-street charging stations across England, making EV charging more accessible to urban and rural drivers alike.

The additional investment builds on previous schemes, such as the Local Electric Vehicle Infrastructure (LEVI) fund, ensuring that convenient and reliable EV infrastructure expands as EV ownership grows.

The government also confirmed that on November 24, new public charge point regulations would come into effect, mandating reliability standards and data transparency for charge points.

This regulatory shift is expected to enhance user confidence, addressing concerns over charge point availability and functionality.

Conclusion

The October 2024 budget delivered mixed outcomes for the EV sector.

While tax rises and the continued fuel duty freeze disappointed those hoping for bolder pro-EV policies, several initiatives provided optimism.

The extension of BIK relief, VED adjustments, and increased funding for EV charge points and gigafactories indicate a commitment to a long-term EV transition.

However, the absence of additional incentives, such as VAT reductions on public charging, left some in the industry questioning the government’s prioritization of EV growth.

As the UK continues its journey toward net-zero, this budget serves as a pivotal moment, with both challenges and opportunities for the EV sector.

For now, EV advocates and industry leaders are hopeful that these measures will drive continued investment and consumer adoption, bringing the UK closer to a fully electrified future.

Blog Archive

- Where Can I Charge My Electric Car?

- Electric Car Maintenance and Servicing Guide

- How Often Should I Charge My Electric Car?

- How to Check EV Battery Health

- Do Electric Cars Pay Road Tax?

- October 2024 Budget: Key EV News

- EV vs ICE – Which is Best?

- Should I Charge My EV to 80 or 90 or 100%?

- UK Government Announces Hybrid Sales Allowed Until 2035

- BEV vs PHEV – What’s the Difference?

- Definitely Not A Guru (Jim Starling) Reviews Joosup

- How Long Do Electric Car Batteries Last?

- 25 New Electric Car Brands on UK Roads

- General Election 2024: Major Party Net Zero Policies Compared

- Electric Car Service Costs vs ICE

- CHAdeMO vs CCS – What’s the Difference?

- Mr EV Reviews Joosup

- What is the ZEV Mandate?

- Spring 2024 Budget: No VAT Rate Cut on Public EV Charging

- What is Regenerative Braking?