Do Electric Cars Pay Road Tax?

As electric vehicles (EVs) continue to grow in popularity, many potential buyers wonder about the costs involved, particularly regarding road tax, also known as Vehicle Excise Duty (VED) in the UK.

For years, EVs have been exempt from road tax as an incentive to reduce carbon emissions, but upcoming changes in 2025 will bring new costs for EV owners.

This guide will cover what VED means for EV drivers, the current situation, the expected changes, and how these will impact vehicle owners.

Chapters

What is UK Road Tax (Vehicle Excise Duty)?

Road tax, or Vehicle Excise Duty (VED), is a tax required for most vehicles on UK roads.

This tax helps fund road maintenance and transport infrastructure.

The amount of VED is primarily determined by a vehicle's CO₂ emissions and fuel type.

The higher the emissions, the higher the VED, as the government aims to incentivise drivers to opt for greener options.

What is Electric Vehicle Road Tax?

Electric vehicle road tax was introduced as an exemption to support the transition to zero-emission transport.

Since EVs emit no CO₂ during use, they have qualified for a £0 VED rate.

This has given EV owners considerable savings versus drivers of petrol or diesel cars, as they typically face annual VED costs based on their car's emissions.

However, this VED exemption for EVs will end on 1st April 2025, aligning EV taxation closer to that of internal combustion engine (ICE) vehicles.

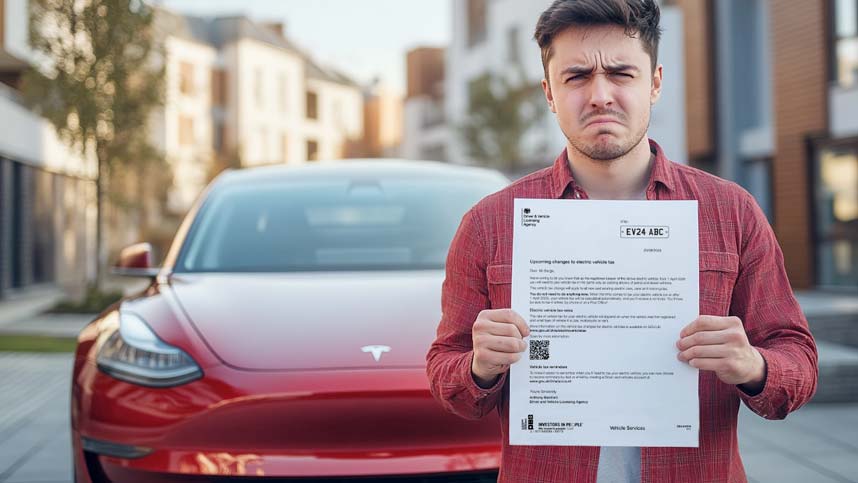

In recent weeks, all EV owners in the UK will have received a letter from the DVLA informing them of "Upcoming changes to electric vehicles tax".

Whilst this change was not unexpected, it is still unpopular, with many electric vehicle owners feeling let down by the government.

Does Every Vehicle Owner Pay Road Tax?

In the UK, most vehicle owners pay some form of VED.

However, there are varying rates:

High-Emission Vehicles

Cars with higher CO₂ emissions face a significant VED cost, with some paying over £2,000 in the first year.

Low-Emission and Hybrid Vehicles

Vehicles that emit low levels of CO₂ pay a lower VED rate, typically around £10-£150 annually.

Zero-Emission Vehicles

Electric and hydrogen-powered vehicles currently pay £0 in VED.

Until April 2025, EVs remain exempt, giving them a cost advantage in annual tax compared to ICE vehicles.

Do Electric Vehicles Need to Be Road Taxed?

As of now, EVs are still VED-exempt, enabling owners to avoid this recurring cost altogether.

But as of April 2025, all EVs, regardless of their registration date, will face road tax.

How Much Road Tax Do Electric Vehicle Drivers Pay Currently?

For 2024, EV drivers enjoy a full exemption from road tax, part of the UK’s broader goal of reducing carbon emissions and encouraging EV adoption.

These savings have been an attractive incentive for drivers choosing to switch from traditional petrol and diesel vehicles.

How Much Road Tax Will Electric Vehicle Drivers Pay from 2025?

From April 1, 2025, EVs will no longer be exempt, and their VED rates will depend on registration dates:

New EVs Registered from April 2025

In the first year, these vehicles will face a nominal fee of £10. From the second year onward, the annual rate will be £190.

Existing EVs Registered Since April 2017

These EVs will also be subject to the standard £190 annual VED rate beginning in 2025.

Older EVs Registered Before April 2017

It remains unclear whether these vehicles will face the same rate, but it’s expected they’ll be treated similarly to other vehicles in the same zero-emission category.

This change means EV drivers must budget for annual VED, though the rate remains lower than for most ICE vehicles.

More details about changes to vehicle excuse duty on electric vehicles can be seen online at the DVLA website.

How is Road Tax Calculated?

VED is calculated based on CO₂ emissions and, in some cases, vehicle value. The tax is usually structured in two parts:

First-Year Rate

Calculated by CO₂ emissions, with higher-emission vehicles paying significantly more.

Standard Annual Rate

Applies after the first year and generally follows a flat rate, with adjustments for higher-value vehicles (covered under the Expensive Car Supplement).

From 2025, EVs will have a flat standard rate for VED of £190, regardless of emissions.

How Will the Changes Affect My Vehicle?

For current EV owners, the 2025 changes will bring an additional yearly expense that wasn’t previously necessary.

While still less than the VED of many petrol or diesel vehicles, this change does impact the financial advantage EV drivers have enjoyed.

For drivers of luxury EV models valued above £40,000, the costs will be even higher due to the Expensive Car Supplement (detailed below).

What is the Expensive Car Supplement?

The Expensive Car Supplement is an additional VED cost applied to vehicles with a list price over £40,000.

Currently, ICE and hybrid vehicles in this bracket must pay an additional £390 annually for the first five years of ownership (after the first year).

Starting in 2025, this supplement will also apply to EVs above the £40,000 threshold, adding to their annual tax.

For example, if you buy an EV priced at £45,000 in 2025, you’ll pay £190 plus the £390 Expensive Car Supplement annually, totalling £580 for the first five years.

Conclusion

The upcoming VED changes in 2025 mark a shift in the UK’s approach to taxing EVs.

Although EVs remain less costly to run as well as to tax than many traditional vehicles, the introduction of these charges closes the gap.

Prospective buyers and current owners should consider these costs when evaluating the total cost of EV ownership.

These changes may also shape the market, influencing purchase decisions as the country progresses toward a sustainable, all-electric future.

For those looking to buy an EV, understanding VED implications and planning for these costs will help ensure a smooth transition into this new era of vehicle ownership.

Blog Archive

- Where Can I Charge My Electric Car?

- Electric Car Maintenance and Servicing Guide

- How Often Should I Charge My Electric Car?

- How to Check EV Battery Health

- Do Electric Cars Pay Road Tax?

- October 2024 Budget: Key EV News

- EV vs ICE – Which is Best?

- Should I Charge My EV to 80 or 90 or 100%?

- UK Government Announces Hybrid Sales Allowed Until 2035

- BEV vs PHEV – What’s the Difference?

- Definitely Not A Guru (Jim Starling) Reviews Joosup

- How Long Do Electric Car Batteries Last?

- 25 New Electric Car Brands on UK Roads

- General Election 2024: Major Party Net Zero Policies Compared

- Electric Car Service Costs vs ICE

- CHAdeMO vs CCS – What’s the Difference?

- Mr EV Reviews Joosup

- What is the ZEV Mandate?

- Spring 2024 Budget: No VAT Rate Cut on Public EV Charging

- What is Regenerative Braking?